-

1 min read

Increasing regulatory oversight makes white labeling a purchase flow risky... unless you know what you’re doing.

White labeling has become a go-to tactic when brands want to keep their experience clean and build customer loyalty. But if you’re using a payments service to handle your transactions, white labeling a purchase flow comes with complexity thanks to a host of regulating bodies.

Earlier this year, the Federal Trade Commission, a U.S. agency tasked with eliminating deceptive business practices, hit UK-based Paddle with a $5 million fine for processing payments without fully disclosing who was involved in the transaction (among other questionable practices). The penalties also included a permanent ban on telemarketer-based payment processing. And the FTC is actively targeting other payments services who have been less than transparent, so there’s an urgent need for sellers to get their labelling right.

In order to do that, the key phrase to understand is Merchant of Record.

The rules for a “merchant” have changed

Before internet commerce took off, a “merchant” was the entity that sold goods/services and processed the payment. When that basically amounted to a physical storefront dealing with a physical customer who walked in the door, one company could handle those transactions without much trouble. Once people could one-click buy items outside their local tax jurisdictions, or even outside their country, things got complicated.

Early internet start-ups quickly recognized that they needed commerce-law experts to handle payments for them. Those services quickly materialized to fill the gap. That's when "seller" and "payments processor" split out into two separate functions:

The Underlying Seller is the provider of goods/services, like a game studio or app developer.

The Merchant of Record (MoR) is a company like Neon who handles all the transactions and carries the liability for fraud prevention, correct tax remitting, and chargebacks.

And that became a very important distinction for card networks like Visa and Mastercard and especially for banks. When those institutions go into risk underwriting, they specifically look to the MoR in all their dealings... not the Underlying Seller.

MoRs are increasingly taking on global obligations

There's no law that specifically codifies "merchant of record," but the FTC’s position is that identifying yourself (on purpose or by accident) as the MoR imposes real-world legal obligations, regardless of branding or platform ownership. And for many years, the card networks have defined what an MoR's obligations and responsibilities are in exact detail.

In fact, Visa annually publishes an 800-page document outlining those details, which is publicly available. If you just want the highlights, the latest version says an MoR must:

Process all payment transactions, whether from credit cards or digital wallets

Manage regulatory compliance across different currencies and tax codes

Mitigate fraud and chargebacks, as well as maintain strict data security

Be displayed consistently in marketing and customer communications

Anyone who doesn’t do all that isn’t the MoR. Anyone identifying as the MoR who isn’t doing all that risks serious legal consequences, as Paddle discovered.

And it’s that fourth point that really gets in the way of white labeling a payments service.

Do’s/Don’ts for white labeling a checkout flow

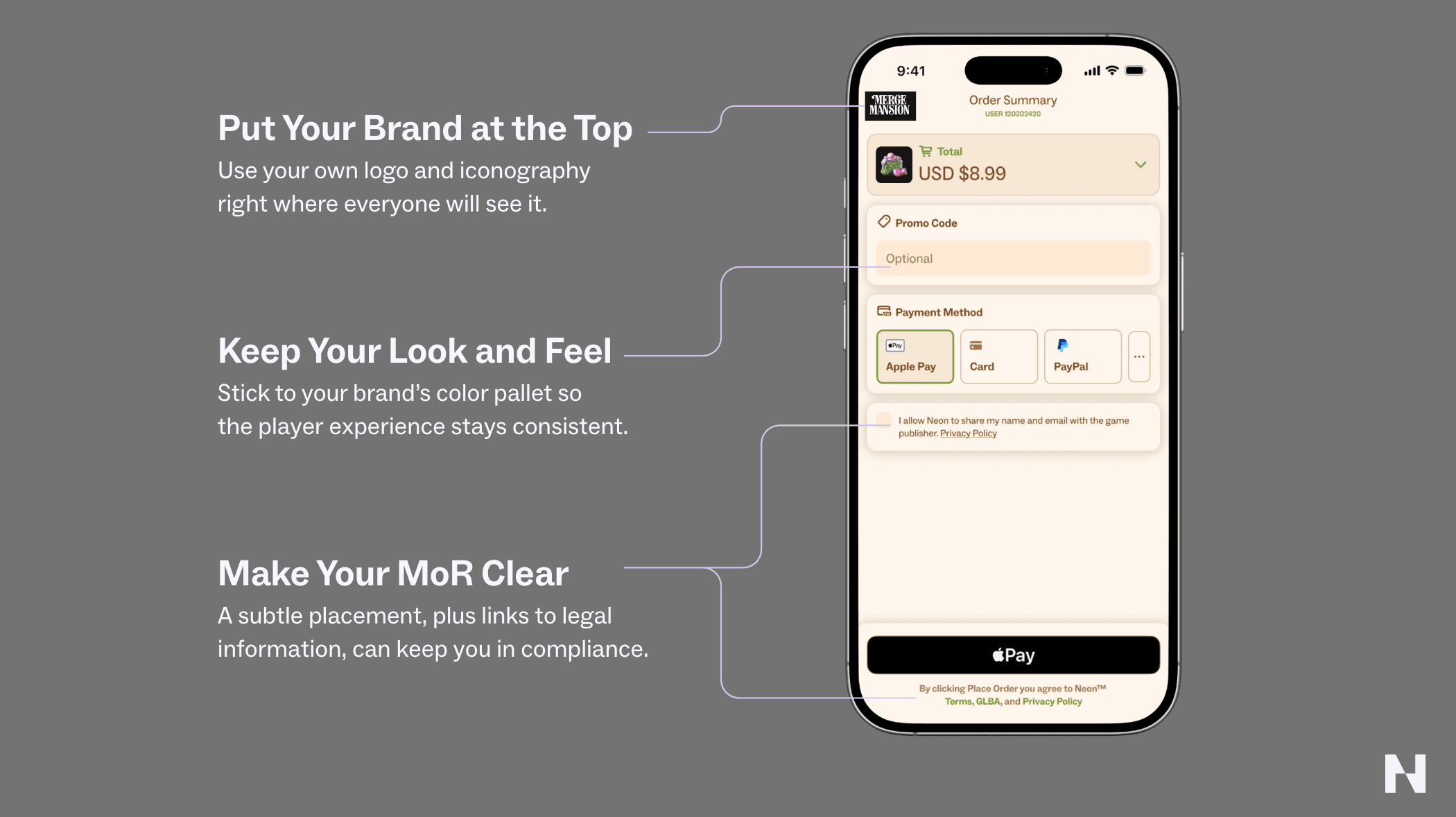

Neon has worked with our clients to create a balance between white labeling our service and keeping the designs legally compliant.

A few things we try to steer clients away from:

Branding your checkout flow as “Powered byYourBrandPay,” or anything else that might mistakenly identify the client as the MoR.

Images or messaging that might imply the client is the MoR.

Offuscating or replacing the MoR name and contact information.

But there are smart ways to maintain transparency while still keeping your brand primary:

Modifying slightly to “YourBrandPay, powered by Neon” puts your company first, but still correctly identifies the MoR.

Using client imagery / color palettes to maintain a consistent feel even in MoR spaces.

Putting the MoR information and legalese in a modal pop-up behind a prominent link.

The goal is transparency... while keeping your brand prominent. That gives your players the experience they want along with the information they’re legally entitled to. And it keeps the liability with the MoR, where it belongs.