-

1 min read

The biggest mobile games now generate 30-44% of their revenue through webshops. This is not a side channel. It is becoming the primary way high-value players spend.

34% of top-performing mobile games have webshops based on data compiled from top 2,690 mobile games.

Here is how 5 of the top mobile game webshops operate, and what the data shows about player adoption.

The Industry Shift

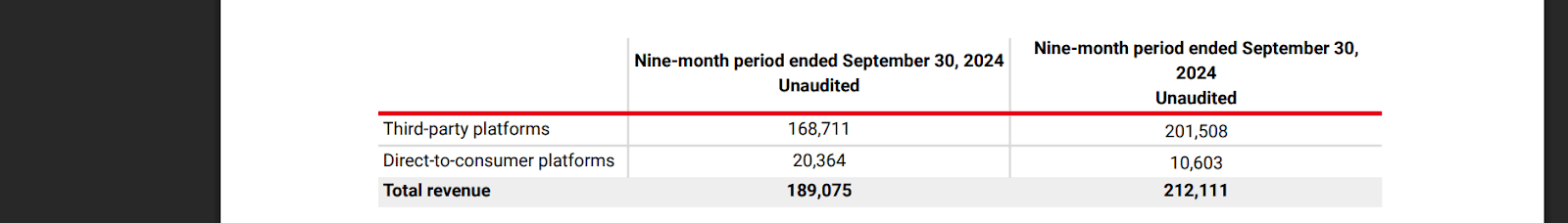

Public companies now report DTC revenue quarterly. The growth trajectories are consistent:

Company | DTC % of Revenue | Growth | Period |

|---|---|---|---|

Stillfront Group | 44% | +11pp YoY up from 33% last year | Q3 2025 |

Huuuge Games | 34% | +92% YoY | Oct 2025 |

Playtika | 31% | +20% YoY | Q3 2025 |

MTG | 24% | +5pp YoY | Q2 2025 |

SciPlay | 18% | targeting 30% | Q2 2025 |

Sources: Stillfront Q3 2025, Huuuge IR, Playtika Q3 2025, PocketGamer

Stillfront's CFO noted that overall gross margin improved by 3 percentage points YoY, driven by higher DTC penetration.

The Growth Trajectories

Two companies show what sustained DTC investment looks like:

Huuuge Games: 8% to 34% DTC in 2 years.

Period | DTC % |

|---|---|

Q4 2023 | 8% |

Q4 2024 | 16% |

FY 2024 | 12% |

April 2025 | 21.5% |

October 2025 | 34% |

DTC revenue tripled in 2023. Then grew 92% again in 2024.

Stillfront Group: 30% to 44% DTC in 18 months.

Period | DTC % |

|---|---|

Q1 2024 | 30% |

Q2 2024 | 34% |

Q3 2024 | 33% |

Q1 2025 | 36% |

Q2 2025 | 39% |

Q3 2025 | 44% |

Sources: Stillfront Q3 2025, Stillfront Q2 2025, Stillfront Q1 2025

Next let’s take a look at some of the largest mobile games by revenue and the characteristics of their webshops.

Pokemon GO Web Store

Owner Scopely generated $545 million in 2024 through the Pokemon Go Web Store, which has earned nearly $8 billion to date, and reaches 20 million weekly active players.

The webshop’s incentive to players is 7-10% more coins than in-app purchases.

Price | In-App | Web Store | Bonus |

|---|---|---|---|

$0.99 | 100 | 110 | +10% |

$9.99 | 1,200 | 1,300 | +8% |

$99.99 | 14,500 | 15,500 | +7% |

The bonus scales inversely with spend. Smaller purchases get better percentages, which drives trial behavior.

Loyalty program:

Simple points-for-items system.

Every purchase earns points.

Points buy raid tickets, incubators, and other in-game items.

First-time buyers get 15% off orders of £9.99 or more.

Supercell Store

Flagship game of Supercell, Clash of Clans alone has exceeded $10 billion in lifetime revenue.

Loyalty program:

Supercell runs 5 games (Brawl Stars, Clash of Clans, Clash Royale, Hay Day, Squad Busters). Their webshop uses a single rewards system that works across all of them, e.g. buy something in the Brawl Stars store, earn points, then spend those points on Clash of Clans or Hay Day items. This portability gives players a reason to consolidate all their spending on the webshop instead of buying in-app separately for each game.

Buy anything, earn Supercell ID Rewards Points, redeem for exclusive items in any Supercell title.

This cross-game portability creates a reason to consolidate spending on the webshop.

Monopoly GO

Loyalty program:

Invite-only. Players must be active for 1 month and reach board level 10. No purchase required for invitation. This creates exclusivity without a paywall.

Every dollar spent earns roughly 65 Loyalty Points ($19.99 = 1,300 points). Points buy sticker packs, dice roll bundles, or exclusive tokens. Spending points also progresses a 90-day Tycoon Pass with milestone rewards. The system incentivizes both spending and returning.

The Tycoon Club is an exclusive membership program for the mobile game Monopoly GO. Data providers cannot track webshop revenue directly, but Hasbro receives licensing fees from the game, the fees keep growing year over year, and the tracked in-app purchase revenue stays flat. This indicates that all the growth is happening through the Tycoon Club purchases.

Playtika DTC Platform

Playtika generated more than $209 million in Q3 2025 DTC revenue through usage of webshops in Slotomania, Bingo Blitz, June's Journey, Caesars Slots, World Series of Poker.

Period | DTC Revenue | % of Total | YoY Change |

|---|---|---|---|

FY 2023 | $639.4M | 24.9% | +5.4% |

FY 2024 | $694.2M | ~27% | +8.6% |

Q3 2025 Quarterly | $209.3M | 31% | +20.0% |

Source: Playtika Q3 2025 Earnings

Q3 2025 was their first quarter to exceed $200 million in DTC revenue. They have raised their long-term DTC target from 30% to 40%.

What the Data Shows

The pattern across all 5 webshops are:

Webshops are no longer experimental. Stillfront went from 30% to 44% DTC in 18 months. Huuuge went from 8% to 34% in 2 years. Playtika just crossed $200 million in quarterly DTC revenue for the first time.

Players are choosing webshops. The Brawl Stars webshop traffic doubled in 6 months. Monopoly GO's growth is happening entirely outside the app stores. When players get better value, they switch.

Margins improve. Stillfront's gross margin rose 3 percentage points from DTC penetration alone.